Food and Beverage cost and pricing calculator

The Formula

Food Cost % = (Beginning Inventory + Purchases Ending Inventory) / Food Sales

Memorize this

FC% = (BI + P - EI) / S

Food cost is calculated by taking beginning (opening) inventory for the period and adding all of your purchases to that number. Subtract the ending (closing) inventory number. This gives the theoretical value of what used that period/ week in product. That number is divided by sales and a percentage of sales is calculated for the cost.

Food and beverage is an essential component of offering guests a good experience, one they want to repeat. A location-based entertainment (LBE) facility with a well-executed food and beverage (F&B) offering will not only increase per capita F&B sales (sales per guest per visit), but will also increase other sales by extending the guests length-of-stay. In fact, F&B can actually be a driver of visits come for the food and stay for the fun. As important as F&B is to the guest experience equation, it is just as important to profitability. When it comes to

F&B profitability, revenue is only one part

of the equation.

The other part of the F&B profit equation is prime cost. LBEs have the potential to achieve per capita F&B sales of $5 or greater. With properly managed prime costs, F&B sales can add $2 in profit for every guest. Prime cost is the total cost of goods sold (COGS). That includes food, beverages and related paper products such as disposable cups, napkins, etc., plus the gross labor cost for all F&B staff.

Labor cost not only includes payroll, but payroll taxes, workers comp, medical insurance and other employee benefits. For a foodservice facility, a good benchmark for prime cost is

60% or less of F&B revenue. This means the total cost of food, beverage, associated paper goods and all labor costs should not exceed 60% of revenues.

It is important to track prime cost on a regular basis, as it includes the two most controllable costs labor and cost of goods sold. However, we often find that LBE operators: Dont track labor costs separately for F&B, but rather lump all labor together for their entire facility, or Track labor as a percentage of F&B sales only on a monthly or less frequent basis, or Rarely track F&B COGS (Cost of Goods Sold) except on an annual basis.

The

problem with such infrequent tracking of prime

cost is that months can pass before the operator

recognizes that costs may have exceeded the

target benchmark. Theres no way to go back and

correct costs at that point, so it represents a

permanently lost profit opportunity. For

example, maybe the costs of some raw products

have increased and driven up food costs. If you

wait for months to find out, then you lost

the opportunity to either adjust menu prices or

find less expensive substitute products. Perhaps

some new employees havent been properly trained

and arent following proper portion control.

Maybe your F&B manager hasnt been efficiently

scheduling employees. Waiting a month or longer

to find out that labor costs are 40% instead of

30% means your costs have been higher than

necessary. Or perhaps an employee has been

stealing some food product out of your walk-in

on a regular basis. Waiting months to calculate

COGS (Cost of Goods Sold) to finally learn

things are out of kilter can mean you let

thousands of dollars walk out the back door

(literally). When it comes to labor costs,

I

recommend that its percentage of revenue be

calculated daily.

Daily, yes, daily! It

isnt that hard to set up your bookkeeping

system to do this. Each morning, the F&B manager

gets a report on what the labor percentage was

for the previous day. That gives you the

opportunity to learn how to improve through

immediate feedback. If you wait weeks or months

to get this information, you will have forgotten

what happened on particular days in terms of

scheduling to cause the high labor cost. If you

gets a report the next morning, however, you can

reflect on the previous day and perhaps learn

what you can do differently to improve the labor

percentage in the future.

The other

advantage of daily reporting is it sends a loud

and clear message to your manager that

controlling labor cost is darned important. The

old adage, That which gets measured gets

attention, is very true. Labor is your most

easily controllable cost, so it only makes sense

to set up a reporting system that helps your

managers stay focused on controlling it.

Calculating the COGS part of prime cost also

needs to be done on a frequent basis. Most chain

restaurants do it weekly. At a minimum, it

should be done bi-weekly. Weekly or bi-weekly

cost reporting will change the attitudes and

behavior of your kitchen staff, as it creates

awareness of the importance of controlling F&B

costs. It also lets employees know they are

being held accountable. If there is a problem,

you will know about it quickly and can respond

accordingly. Regular food costing will usually

result in a 2% to 4% or more reduction to

COGS.(Cost of Goods Sold) Again, that which gets

measured gets attention. Calculating COGS (Cost

of Goods Sold) requires a physical inventory of

all F&B supplies on hand and a calculation of

their costs. This takes some time, but with a

well-organized stockroom and by setting up

simple inventory worksheets, a physical

inventory can easily be done in an hour or so.

Conducting regular physical inventories also

requires the discipline of setting a fixed

scheduled time for it.

When auditing the

operations from other companies, or even I ask,

I found that the menu prices have not been

appropriately calculated to produce desired

profit margins. I frequently find COGS (Cost of

Goods Sold) running at 40%, 50% or greater of

their F&B sales. I often find that they have

priced their menu items under the market for

similar type restaurant operations, sometimes

for even less than other sells those items.

Never price your menu items cheaper than

comparable restaurant prices. Menu prices that

are too low can actually hurt sales, as guests

will be suspicious that the food quality is low,

based on the price.

Actually, with good

quality products and display cooking, such as

preparing foods right in front of customers, you

can command a premium price over comparable

restaurant operations. The public looks at it as

more of a value equation than just an absolute

price consideration when purchasing quality

prepared foods.

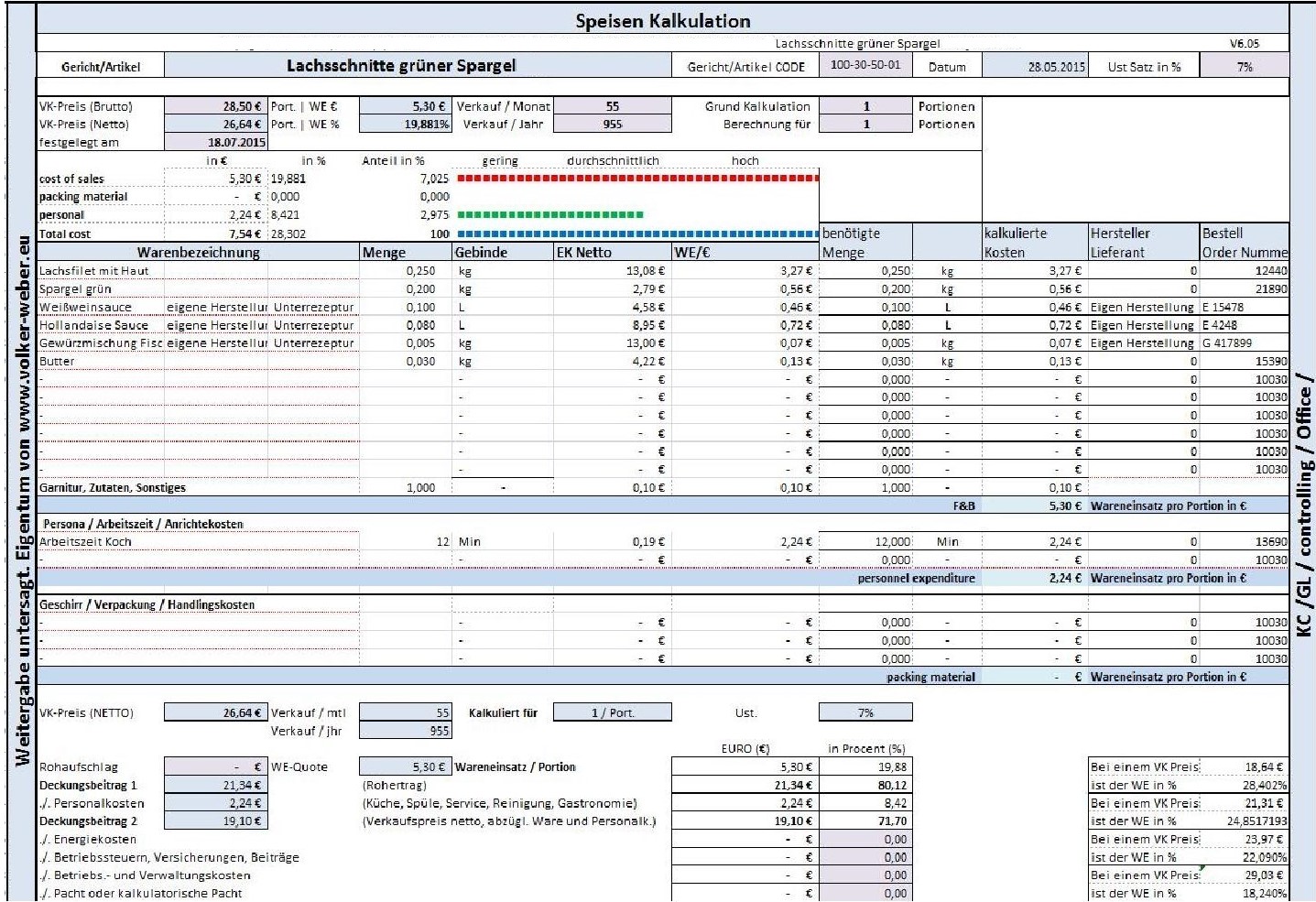

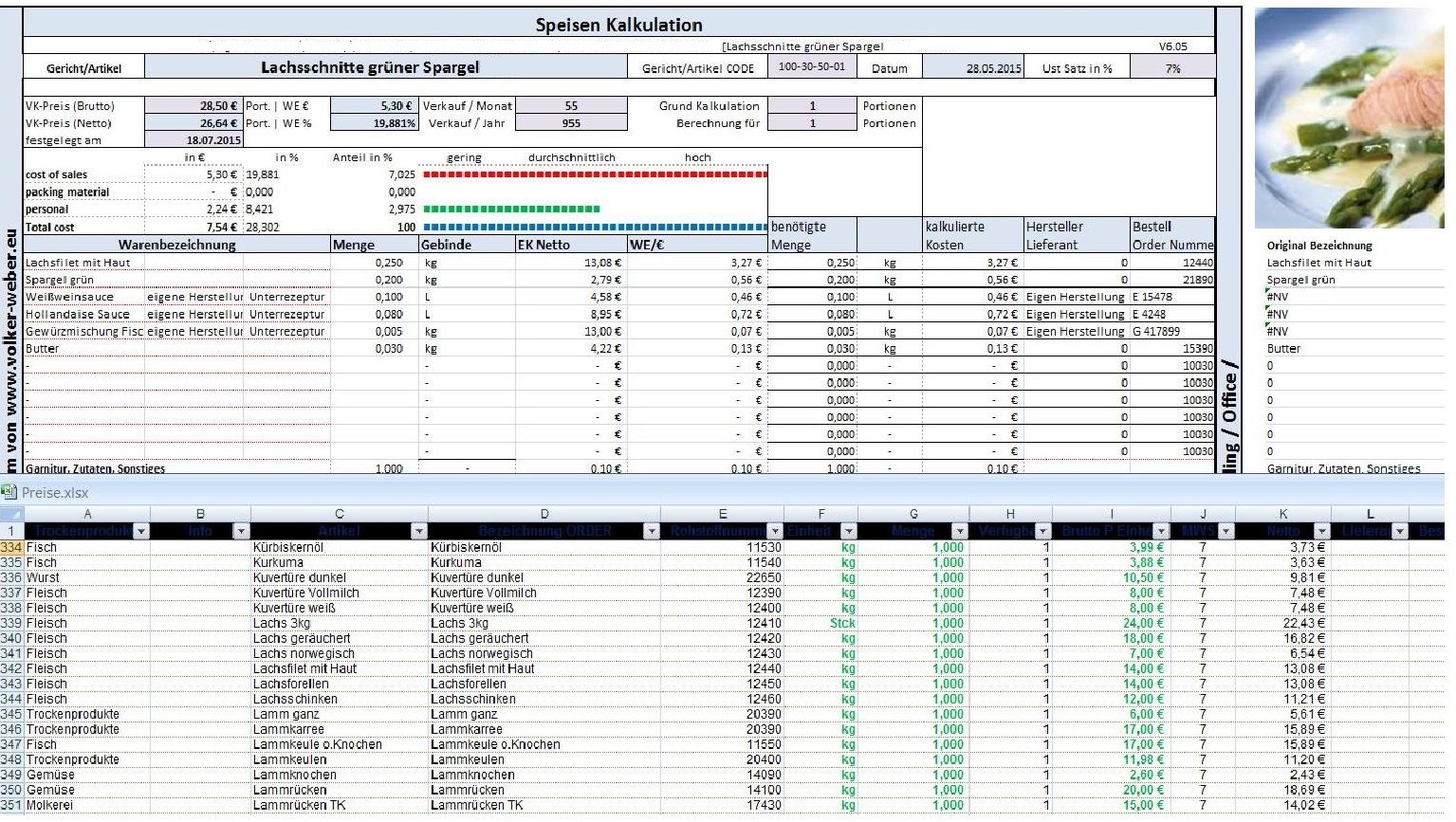

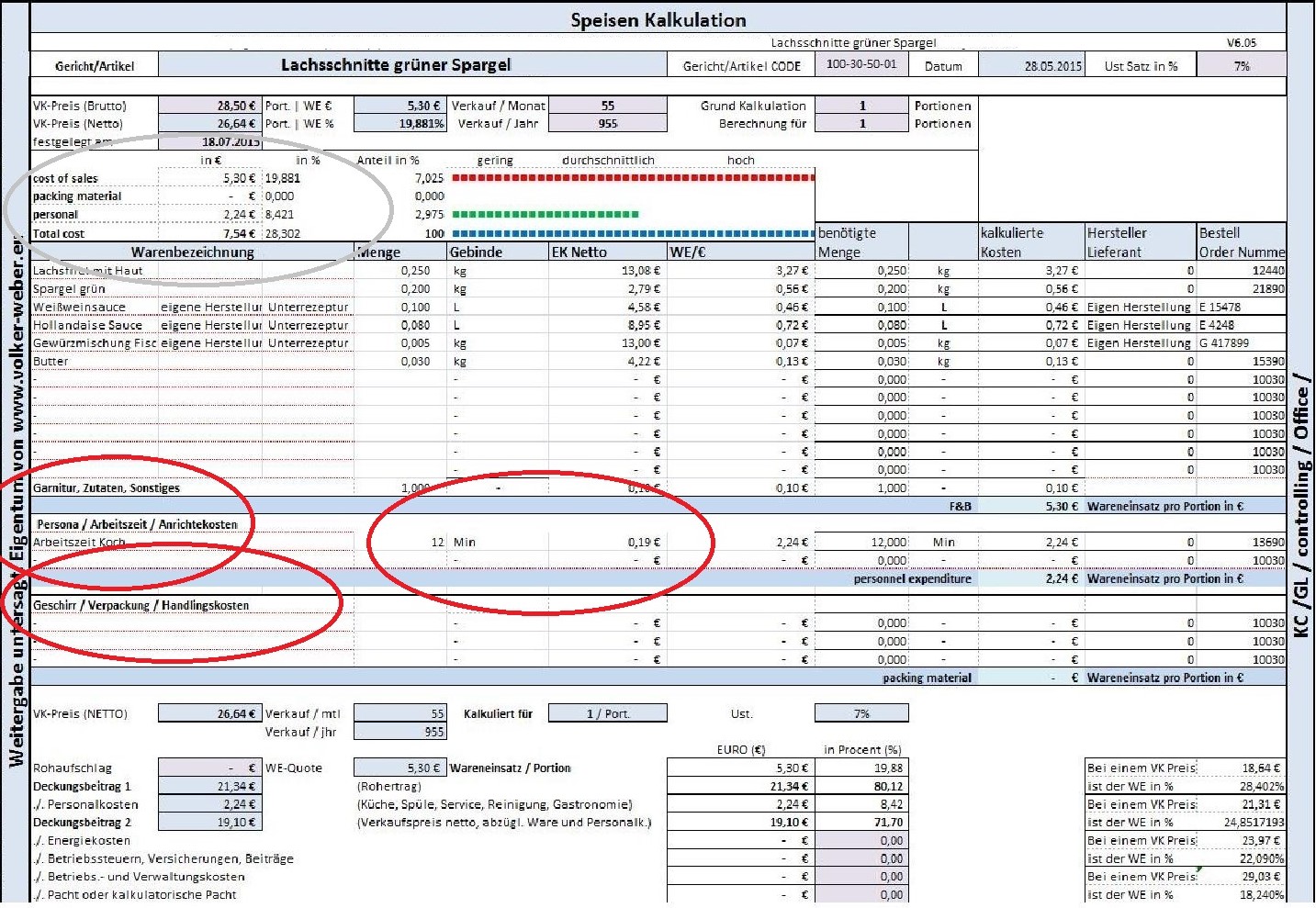

Properly setting menu

prices requires a detailed cost analysis of each

menu item, making sure the cost includes every

ingredient and paper product used for that item.

For example, for a sausage, the cost

analysis should include not only the sausage and

roll, but also the cost of condiments, the paper

plate and napkins. Then a factor needs to be

added for waste food that spoils, dropped food

that is thrown away, and prepared left over food

that cant be saved at the end of the day. Take

the total cost of the menu item and divide it by

your desired COGS.(Cost of Goods Sold). Lets

say the total cost of the gourmet sausages works

out to $0.76 and you want to maintain a COGS of

30%. You divide $0.76 by 30% to get the

target-selling price of $2.54. But you dont

stop there. If sausages of a comparable quality

are selling for $2.89 in your market, you set

the price at $2.89, which gives you a 28% COGS.

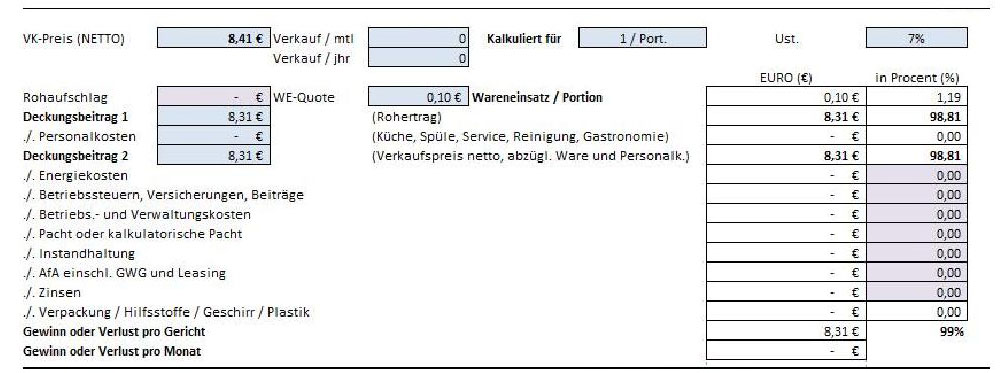

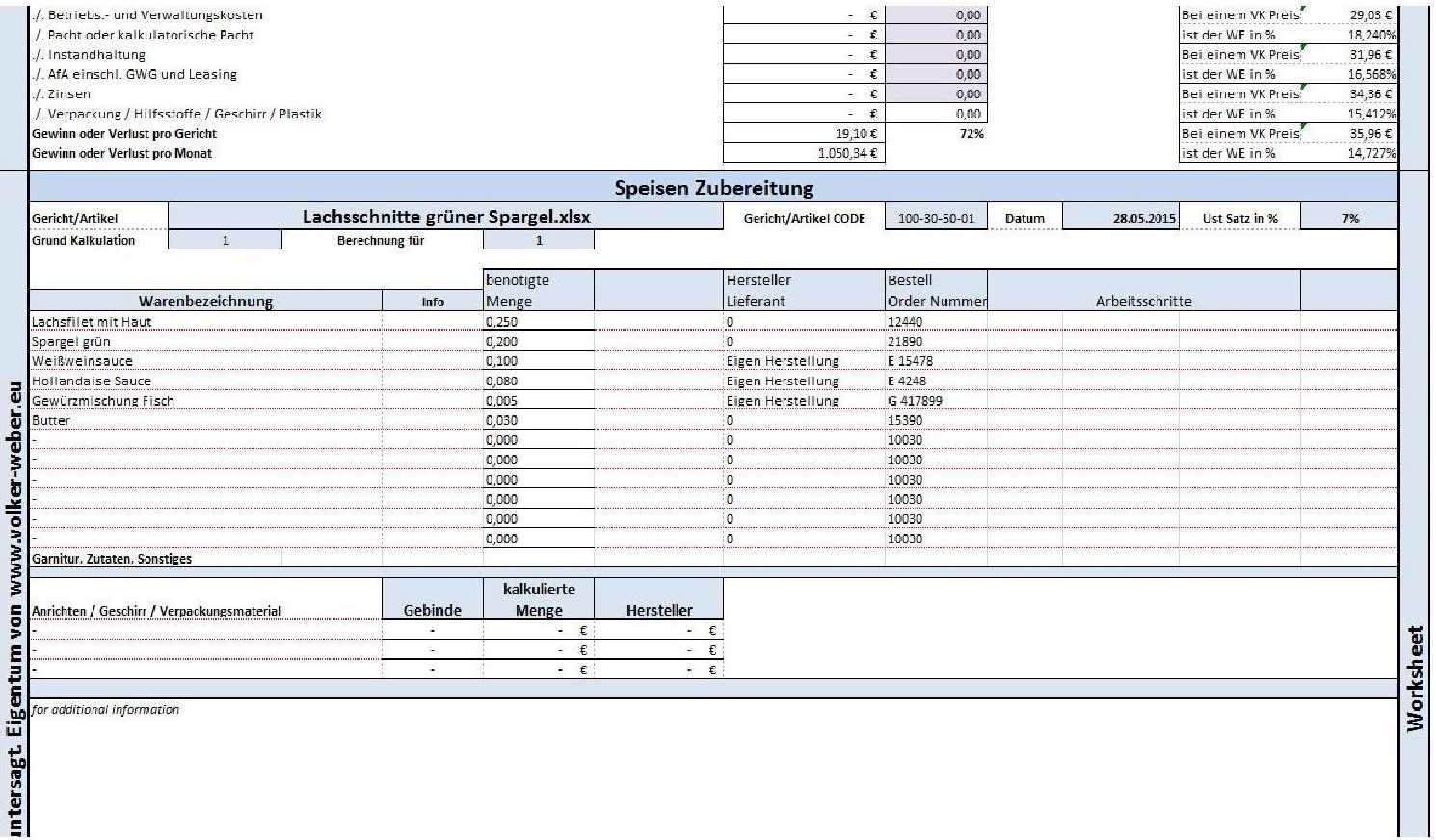

A worksheet for this example is shown below.

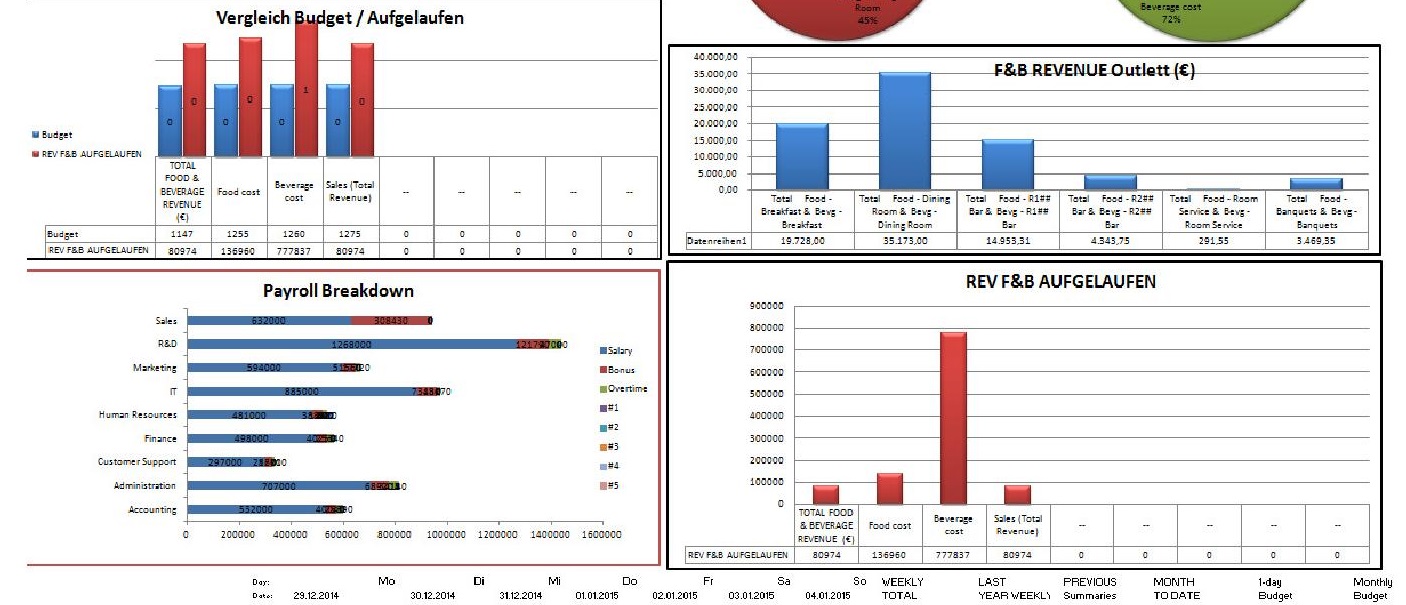

I have found that in addition to supplying labor costs and COGS to managers, taking an open-book approach of sharing this information with all F&B staff greatly improves performance. I advise where the F&B staff will see them everyday. One can show the weekly labor percentage and the other the weekly or bi-weekly COGS. The vertical axis should show ascending percentage and the horizontal axis should indicate the time periods. The target range should also be shown.

It gives them immediate feedback on how they are performing. Staff members have far more control of COGS than anyone else, because they handle portion control. They create waste. They are doing (or not doing) the up-selling to more profitable food items. The graphs will help them understand why proper portion control, minimizing waste and up-selling are so important. It lets the F&B staffers know they are regularly being evaluated in these performance areas. It also lets them know that if they steal, their theft will quickly show up in the performance results. And if their hours need to be cut back, they can better understand why -- that it is necessary from a business profitability standpoint and is not some arbitrary management decision.

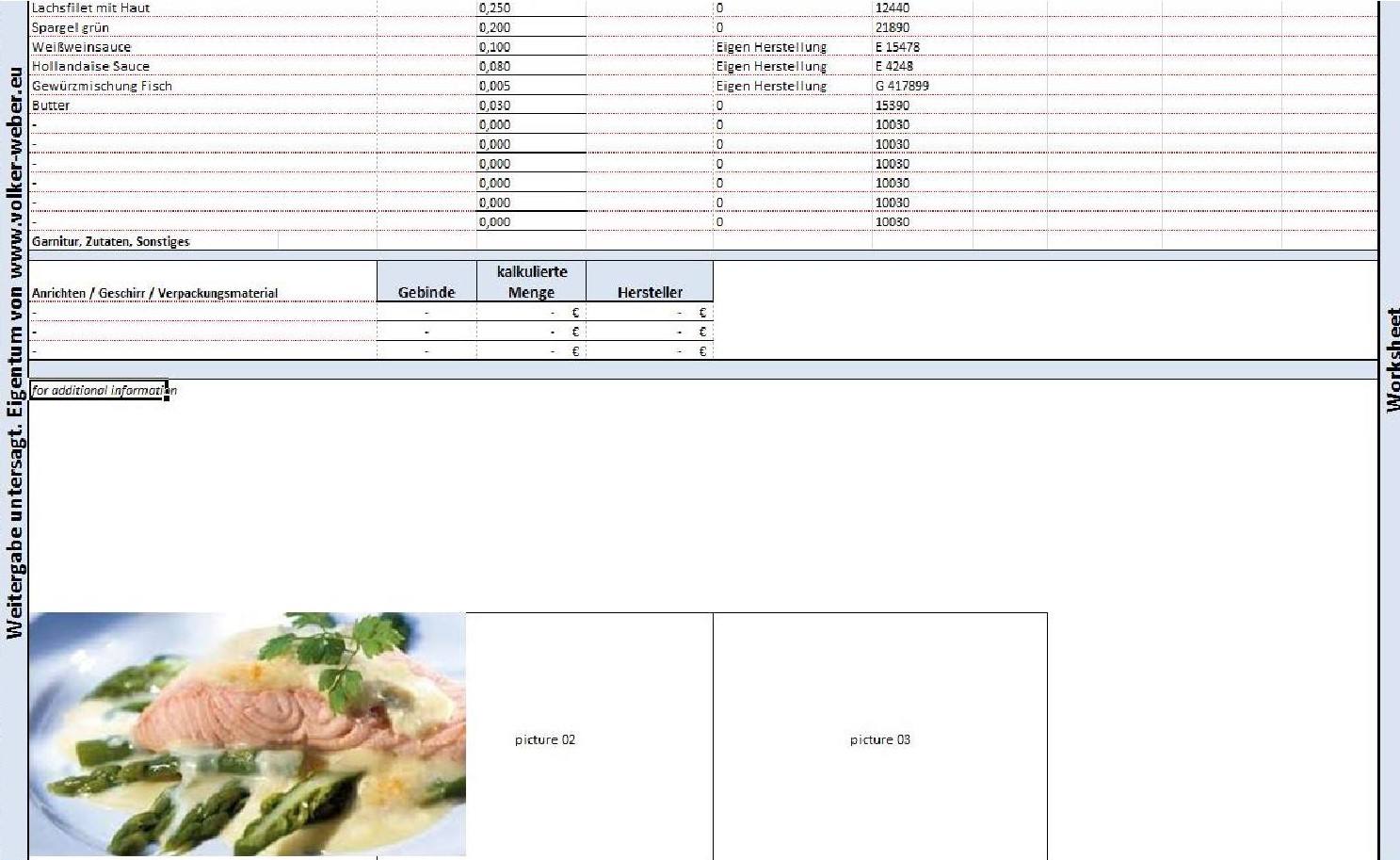

Controlling prime cost requires commitment, procedures and discipline. When executed properly, you will have a continuous stream of profits from your food and beverage sales. B t w, my thanks to White Hutchinson. Here are some of my software examples for food calculation. They should be available in each operation / F&B department.